The Pinnacle of Protection: Your Ultimate Overview to Insurance Solutions in 2024

The Pinnacle of Protection: Your Ultimate Overview to Insurance Solutions in 2024

Blog Article

Why Insurance Is a Smart Financial Investment for Your Tranquility of Mind

Insurance policy is often viewed as an abstract financial investment, one that does not right away supply the same level of excitement as acquiring a brand-new auto or investing in the securities market. It is precisely since of this lack of instant gratification that insurance becomes a wise investment for your peace of mind. In a world filled with unpredictabilities and unpredicted occasions, having the appropriate insurance coverage can give a feeling of security and protection that is very useful. Whether it is safeguarding your health, safeguarding your belongings, or ensuring the financial security of your liked ones, insurance serves as a safeguard that can alleviate the problem of unforeseen scenarios. It goes past that; insurance policy uses a peace of mind that allows you to live your life without continuous concern or concern. So, why is insurance a smart financial investment for your comfort? Let's check out the different types of insurance plan, their benefits, and variables to consider when choosing insurance, to understand exactly how insurance coverage can genuinely supply the harmony we all look for in our lives.

Importance of Insurance Coverage

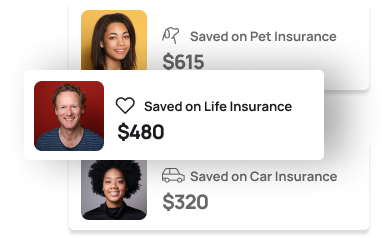

Insurance insurance coverage is an essential component of financial planning, providing necessary defense and assurance against unanticipated occasions. Despite one's financial circumstance, insurance policy protection is a clever investment that assists people and families guard their assets and safeguard their future. Whether it is wellness insurance policy, life insurance policy, vehicle insurance coverage, or property insurance coverage, having ample insurance coverage can alleviate the economic burden that includes unexpected circumstances.

Among the main factors insurance policy protection is very important is its capability to secure versus financial loss. Health and wellness insurance ensures that medical expenditures are covered, stopping individuals from having to birth the complete brunt of expensive clinical expenses. In a similar way, life insurance coverage supplies economic assistance to loved ones in the event of the insurance policy holder's death, guaranteeing that their dependents are not left without the ways to sustain their lifestyle. Insurance Solution In 2024.

Insurance coverage likewise offers assurance. Understanding that you are protected versus unexpected occasions can minimize stress and anxiety, allowing people to concentrate on other facets of their lives. It supplies a complacency, recognizing that if a mishap, health problem, or all-natural disaster were to happen, there is a safeguard to draw on.

Additionally, insurance policy coverage advertises liable financial planning. By having the essential protection, individuals can better handle their financial resources and allocate sources effectively (Insurance Solution In 2024). It urges individuals to believe long-term and think about the possible dangers they might encounter in the future, ensuring that they are appropriately prepared

Kinds Of Insurance Coverage Plans

One typical kind of insurance is life insurance policy, which offers a survivor benefit to the beneficiaries in case of the insured's fatality. This sort of plan can assist offer financial protection to liked ones and cover expenses such as funeral prices, impressive financial obligations, or earnings replacement.

Medical insurance is one more important kind of insurance coverage that aids family members and individuals manage medical expenditures. It can give insurance coverage for medical professional sees, health center stays, prescription medications, and precautionary care. Health and wellness insurance plans can be acquired with companies, federal government programs, or bought individually.

Residential or commercial property insurance policy is made to secure against damages or loss to physical possessions, such as companies, homes, or automobiles. This sort of insurance coverage can aid people recover economically from occasions like fire, theft, or all-natural calamities.

Other types of insurance coverage plans include automobile insurance, which covers injuries or damages resulting from vehicle crashes, and straight from the source obligation insurance policy, which shields people or companies from legal cases for bodily injury or building damages.

Advantages of Purchasing Insurance Coverage

Investing in insurance policy supplies individuals and households with indispensable monetary security and tranquility of mind in the face of unforeseen occasions or losses. Insurance policy acts as a safety internet, ensuring that people are monetarily shielded when faced with unanticipated scenarios. One of the essential benefits of investing in insurance is that it uses monetary stability and safety and security throughout hard times.

Variables to Take Into Consideration When Choosing Insurance

When picking an insurance coverage, it is critical to think about a series of variables that align with your specific requirements and monetary situations. These elements can help ensure that you pick a policy that gives you with sufficient protection and meets your certain requirements.

Firstly, it is important to analyze the kind of insurance protection you need. This could consist of health and wellness insurance coverage, life insurance policy, car insurance coverage, or property owners insurance policy, to name a few. Each kind of insurance coverage supplies different advantages and defense, so it is vital to figure out which ones are most appropriate to your scenario.

Second of all, you ought to think about the expense of the insurance policy premiums. It is necessary to review your budget plan and figure out just how much you can pleasantly afford to pay for insurance policy coverage. Bear in mind that greater costs may supply much more extensive protection, but they might additionally strain your finances.

Last but not least, it is a good idea to review the conditions of the insurance policy meticulously. Recognizing the protection restrictions, deductibles, exclusions, and any type of added benefits or bikers will help you make a notified choice.

How Insurance Policy Provides Comfort

Insurance policy supplies individuals the assurance and security they require to navigate life's unpredictabilities with confidence. Life has lots of unexpected events and dangers, such as mishaps, health problems, and natural disasters. These events can cause significant monetary worry, emotional tension, and interruption to our lives. With the appropriate insurance protection, individuals can discover peace of mind recognizing that they are shielded financially versus these risks.

Insurance policy gives peace of mind by offering monetary protection in the face of adversity. Health and wellness insurance policy guarantees that individuals receive needed medical care without the fear of inflated clinical expenses.

Furthermore, insurance policy supplies satisfaction by supplying protection for loved ones in the event of unforeseen scenarios. Life insurance policy, as an example, offers an economic safeguard for households in the event of the policyholder's death. This insurance coverage assists to make sure that dependents can preserve their standard of life, repay debts, or cover educational expenses.

Insurance coverage likewise provides assurance her response by offering lawful defense. Obligation insurance coverage, such as professional responsibility or general liability insurance policy, safeguards people from lawful insurance claims and monetary losses arising from mishaps or neglect.

Verdict

In conclusion, investing in insurance policy is a wise decision as it provides people with peace of mind. Insurance coverage is vital for guarding versus unpredicted occasions and prospective monetary losses.

Whether it is health insurance, life insurance policy, car insurance find here coverage, or residential property insurance policy, having appropriate coverage can relieve the monetary problem that comes with unanticipated conditions.

Wellness insurance coverage makes sure that clinical expenditures are covered, preventing individuals from having to bear the complete impact of pricey medical expenses.Having actually developed the relevance of insurance coverage, it is currently important to discover the numerous types of insurance policies offered to people and households. This could include wellness insurance, life insurance coverage, auto insurance coverage, or house owners insurance policy, among others.

Report this page